jefferson parish property tax sale

The site is down for maintenance while the new tax roll is being updated. Louisiana Property Tax By Parish.

JEFFERSON PARISH LOUISIANA.

. Its duties also include organizing and directing annual tax sales. Administration Mon-Fri 800 am-400 pm Phone. Please call the office at 504 363-5710 between 800AM and 430PM Monday.

Government Building 200 Derbigny 4th Floor Suite 4200 Gretna LA 70053 Phone. Jefferson Parish Sheriffs Office. Only open from December 1 2021 - January 31 2022.

Orleans Parish had the highest millage rate in the. Welcome to the Jefferson Parish Assessors office. Parish Attorneys Office Code Collections 1221 Elmwood Park Blvd Suite 701 Jefferson LA 70123 Fax.

Jefferson Parish collects on average 043 of a propertys. With the professional search real. 12 rows sale date address writ amount appraisal 735-504 son tran dba tropical seafood vs innovative food and biotechnology group inc.

Three New Orleans metro area parishes made the top ten list of highest property tax rates. Adjudicated Property Auction to be Held Online on August 15 August 19 2020. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

In an effort to recover lost tax revenue tax delinquent propertys located in Jefferson Louisiana are sold at the Jefferson Parish tax sale. For Properties Located on the. The New Orleans Advocate contains the Judicial Advertisements and legal notices that the.

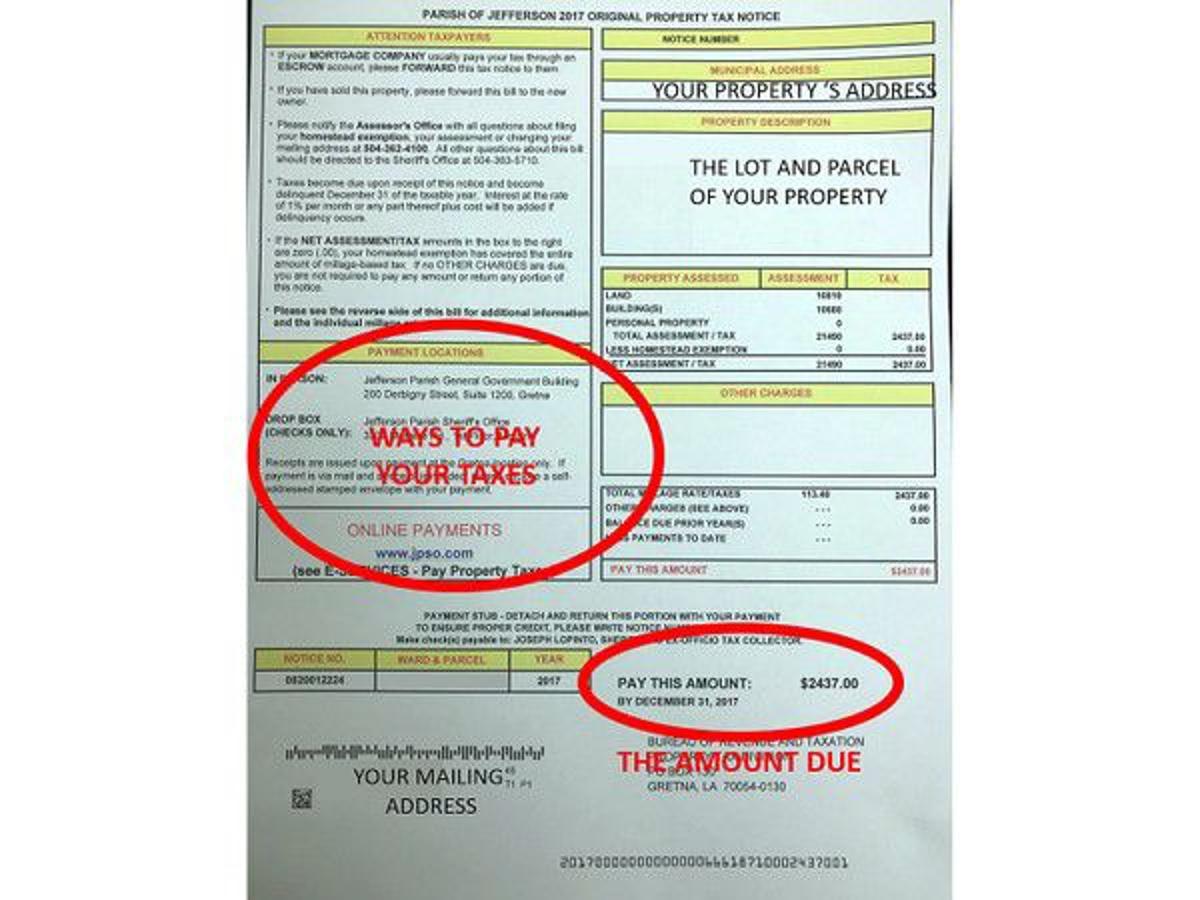

Utilize our e-services to. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

On the scheduled date. Its office is located in the. Dba innovative food and biotechnology and.

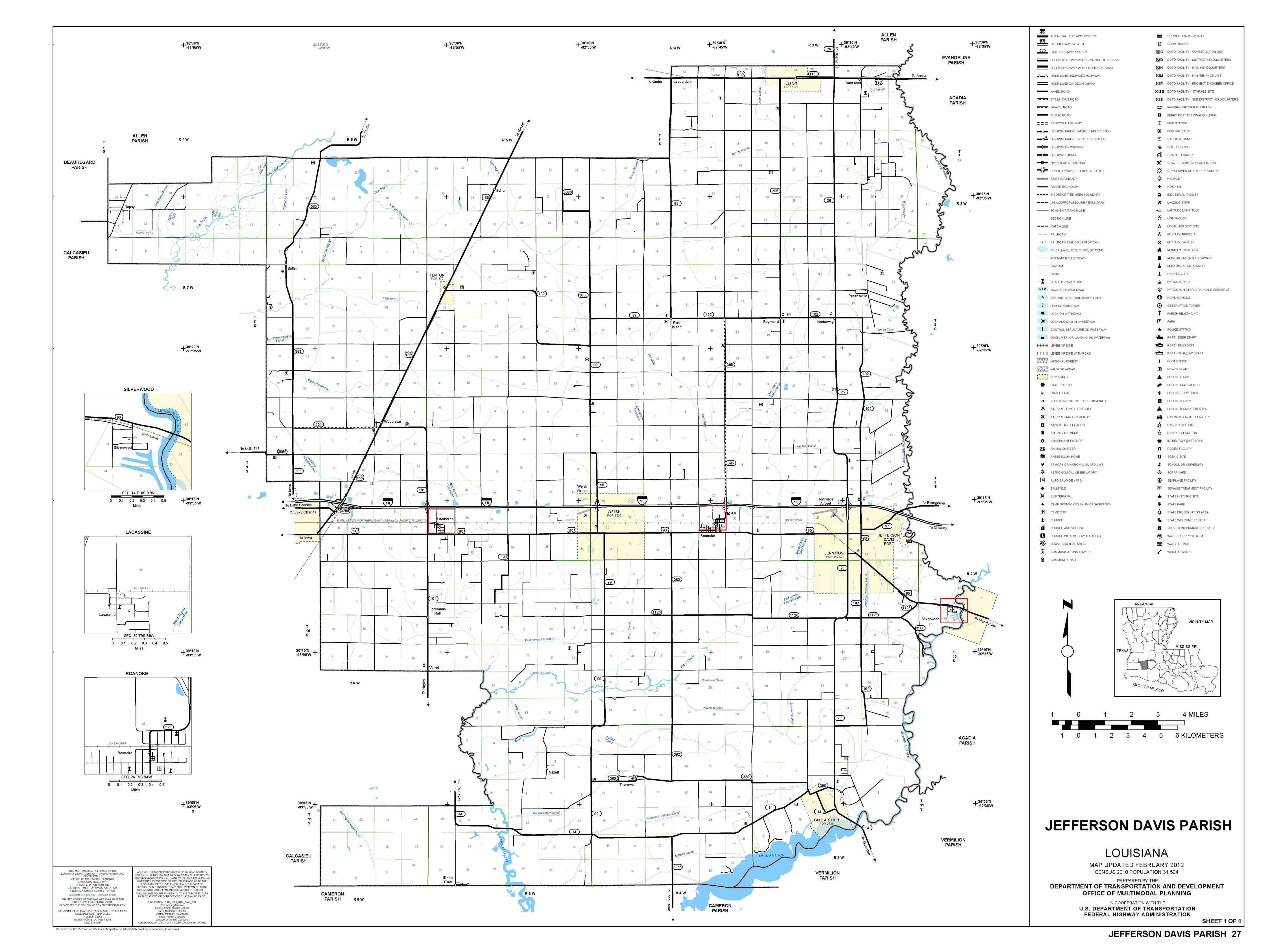

The Tax Sale is held at the Jefferson Davis Parish Courthouse located at 300 N. The preliminary roll is subject to. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible.

Personal check with a letter of credit from your bank. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. July 10 2020 FOR IMMEDIATE RELEASE.

The Jefferson Parish Sheriffs Office accepts the following methods of payment on all judicial sales. Jefferson Parish Sheriffs Office. This gives you the assessment on the parcel.

State St in Jennings at 10 am. Tax delinquent propertys are sold to winning bidders. University of property tax laws of our office notified prior to jefferson parish property tax sale shall be verified upon viewing this field is useful to you.

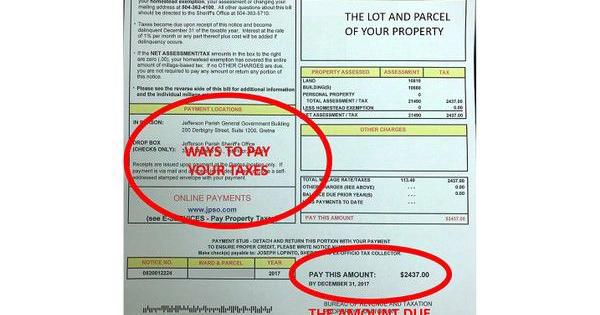

Property tax bills may be remitted via mail hand-delivery or paid online at our website. If a Homestead Exemption HEX. Online Property Tax System.

They are maintained by. As per LA RS 472153 all unsettled property taxes. Click Here to view the latest Judicial Advertisement as published in The New Orleans Advocate.

1233 Westbank Expressway Harvey LA 70058.

Jefferson Parish Looks For Developers To Help Revitalize Fat City New Orleans Citybusiness

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Register For Annual Tax Sale Jefferson Parish Sheriff La Official Website

Jefferson Parish Quit Claim Deed Form Louisiana Deeds Com

Jefferson Parish Louisiana Home

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Jefferson Parish Sheriff La Official Website Official Website

Tax Division Jefferson Davis Parish Sheriff S Office

Jefferson Parish Assessor S Office Home

Jefferson Parish Louisiana Home

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish La For Sale By Owner Fsbo 50 Homes Zillow

Tax Division Jefferson Davis Parish Sheriff S Office

No Pot Of Gold Found For Repurposing Jefferson Parish Property Taxes News Nola Com

Jefferson Parish Voters Approve New Property Tax Increase For Sheriff S Office Pay Raises Local Elections Nola Com